Visualizing the Racial Wealth Gap

Systemic inequities and barriers keep people of color from achieving economic security through employment, education, and homeownership, resulting in racial disparities in wealth and income. These disparities are the consequence of ongoing discrimination, structural inequality, and biases across our institutions. They continue to emerge in new forms of technology — including artificial intelligence and algorithmic risk assessment tools — that influence nearly every facet of life. The confluence of these inequities has created a massive, persistent racial wealth gap in the United States.

Here are three things you should know about the racial wealth gap:

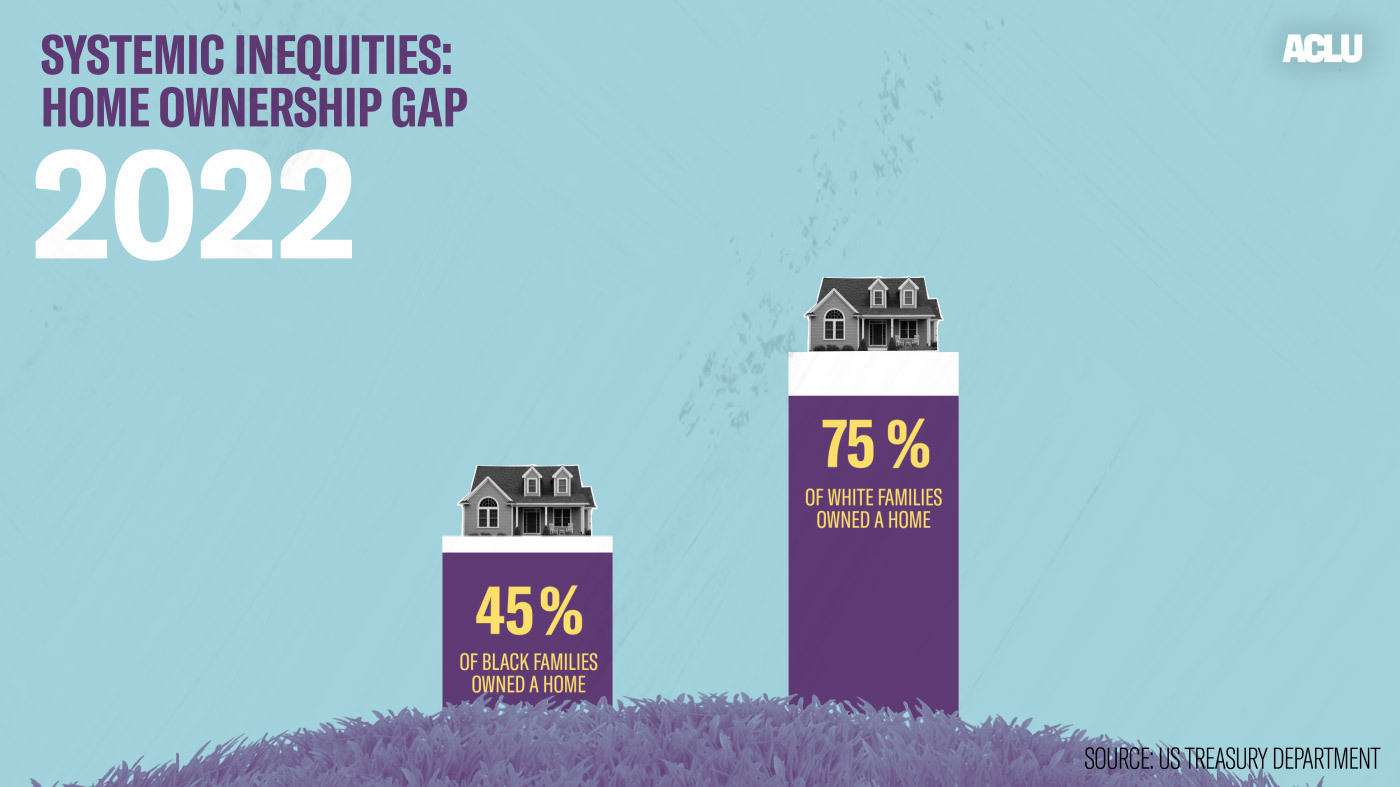

Homeownership

Homeownership has been one of the most effective ways that Americans build wealth, which can be passed down from generation to generation. And although equal access to housing is a civil right, systemic racism within our housing institutions has long kept communities of color from accessing fair housing opportunities. The gap between Black and white families' home ownership has persisted over the years. In 1976, the gap between Black and white families’ home ownership was 25 percent (44 percent of Black families owned a home, compared to 69 percent of white families). In 2022, the gap grew even more to 30 percent (45 percent of Black families owned a home, compared to 75 percent of white families).

Mortgage Loans

When applying for mortgage loans, Black applicants were 1.8 times more likely to be denied for a mortgage than white applicants, while Latino applicants were 1.4 times more likely to be denied than white applicants, according to an analysis of 2019 data. The racial bias in mortgage interest rate is most exemplified by those who earn between $30,000 to $44,999 in annual income, where the median interest rate for Black homeowners is 6.95 percent higher than that of white homeowners.

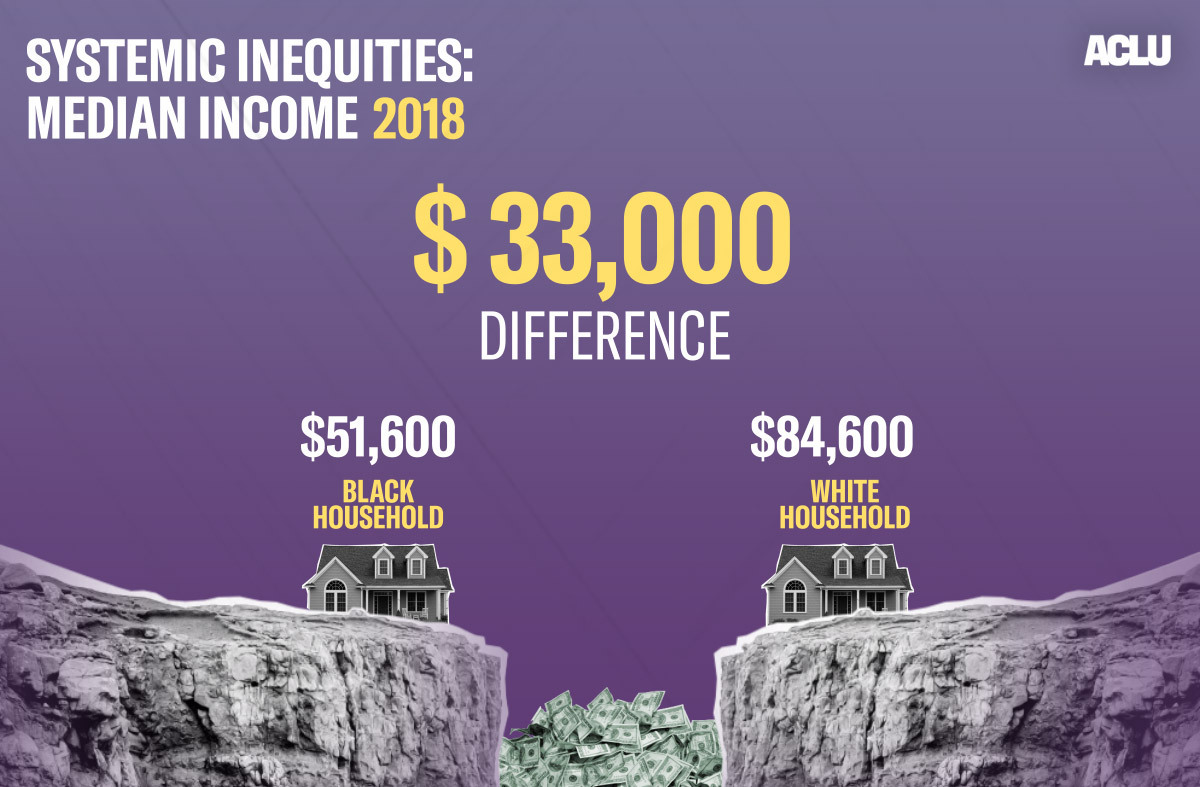

Median Income

The Black-white income gap has persisted and grown since 1970, from a gap of $23,700 in 1970, when the median income for a Black household was $30,400 compared to $54,100 for a white household, to $33,000 in 2018, when the median income for a Black family of three was $51,600 compared to $84,600 for a white family of the same size.

The economic position of Black Americans relative to white Americans over the years remains precarious at best. Through litigation and advocacy, the ACLU works to remedy deeply entrenched sources of inequality and ensure that access to opportunity and the ability to build wealth is available to all. We’ll continue to tackle the roots of the problem by breaking down systems designed to discriminate against Black, Indigenous, and other people of color.

Donate to the ACLU

The ACLU has been at the center of nearly every major civil liberties battle in the U.S. for more than 100 years. This vital work depends on the support of ACLU members in all 50 states and beyond.

We need you with us to keep fighting — donate today.

Contributions to the ACLU are not tax deductible.